Repaying student loans may now be easier

by Abby Musser – News Editor

As my brother Josh Musser, a Hesston alumnus, unlocks his apartment door with his mail in hand, he notices a bill from his loan creditor. He groans and throws the letters on the table by the door. Although he graduated in 2012, he is still paying off about $13,000 in loans and like many college graduates, will continue to do so for a long time. However, repayments are now easier to make thanks to the Obama Administration.

Last June President Obama signed an executive order that expands the PAYE, or pay as you earn, bill that will let students cap their monthly federal student loan payments at 10 percent of their income. After 20 years, or 10 years if working in public service, of repayments the remaining balance will be forgiven. Five million more people will now be eligible starting December 2015.

Although this bill was originally drafted and signed back in 2010, not many students have taken advantage of it. Anthony Carnevale, director and research professor at the Georgetown University Center on Education and the Workforce, theorizes the reason that the original bill did receive not much attention was because students did not know about it.

“What we know is that students don’t seek these kind of repayment programs out,” Carnevale said in an interview with NPR’s Michel Martin, “In many cases, even students who default never even knew about these options.”

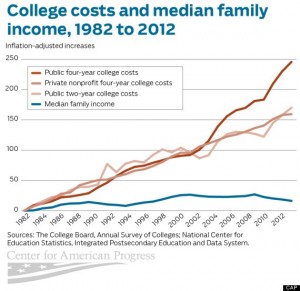

It is no secret that college in the United States has gotten more expensive over the years. How expensive it has become though might be a little surprising. According to College Board, a non profit designed to help students transition to college, in the 1973-1974 school year the average cost of tuition plus room and board for a four year non-profit college was $10,783. In the 2013-2014 school year, for the same type of institution, the price has changed to $30,094. Since very few people can afford that amount out of pocket, students have to find a way to pay.

It is no secret that college in the United States has gotten more expensive over the years. How expensive it has become though might be a little surprising. According to College Board, a non profit designed to help students transition to college, in the 1973-1974 school year the average cost of tuition plus room and board for a four year non-profit college was $10,783. In the 2013-2014 school year, for the same type of institution, the price has changed to $30,094. Since very few people can afford that amount out of pocket, students have to find a way to pay.

Marcia Mendez, director of Financial Aid at Hesston reported that nearly 65 percent of students borrow some amount of money to attend Hesston. For many of them, being able to pay off their loans may see far off, but there are some things that students can start doing now.

“It’s important to set up a budget while you’re in school and also once you are finished with school,” said Mendez. “Live as frugally as you can while going to school and borrow only what you absolutely have to have. Make some sacrifices as you start out and get those loans paid off as quickly as possible.”

To learn more about the PAYE plan and its qualifications, as well as all the other repayment plan options, students should go to www.studentloans.gov.